How To Reconcile Etsy Deposits | Etsy Accounting

How Do I Reconcile My Etsy Deposits?

Recently I was working with an Etsy seller who claimed she was owed $20,000 by Etsy.

That is a lot of money.

She decided she needed some outside help to reconcile her Etsy deposits to her actual bank account because her “Etsy Deposits don’t match actual bank deposits”, she could not reconcile between the two, kind of a big deal I would say.

So, in this blog today I want to clear this up for you so that you can see how Etsy actually deposits the money into your bank account so you can do your Etsy taxes and Etsy bookkeeping a little easier.

Let’s first start with the actual process of how Etsy deposits the money and then we can work through this using a real easy example with visuals and everything…

Here is how it normally works…

You make a sale (yay!)

Let’s say the sale is for $10

Etsy takes it’s cut of 5% per sale or $.50 (not yay!)

That leaves you with $9.50 of money that SHOULD be deposited into your bank account…but you and I know we get a little less than that ☹

So, why is that?

In this blog I am going to break down the Etsy seller reports and Etsy deposits into detail like you have never seen and actually help you make some sense of just exactly how much money you should be getting each and every time….and also answer the question of “how do I reconcile my Etsy deposits”

I think the easiest way to explain this is this way…

You have to think of Etsy like an actual bank account, and it kind of makes sense, right?

Etsy collects all of this money for you, takes some fees and then eventually deposits money into your ACTUAL bank account, it’s just that along the way Etsy takes some fees from you, along with some shipping labels, some listing fees, some processing fees, some marketing fees

...and probably your first-born child…kidding about that part…maybe

Anyway, no more bad jokes…let’s break this down…

The first thing to be aware of is that in Etsy there are SO many numbers and spreadsheets and financial data that it is hard to make sense of just exactly where to start and the most common question I get “what number do I use for Etsy” …

To make this easy, there are only two reports we want to be aware of…

The “Etsy Monthly Statement”

And the “Etsy Deposit Detail”

These two reports are the most important in reconciling between what your Etsy account says and what your bank account says…

The problem with Etsy is that they do not make it easy or combine all of this information onto one spreadsheet for you to do your Etsy bookkeeping and Etsy accounting…

…. you have to do a bit of reconciling between them…and this is where I come in…

Let’s first go into reconciling the Etsy deposits to the actual bank deposits…

To do this, we will need both reports downloaded and you can do it like this…

The Monthly Etsy Statement you can access like this…

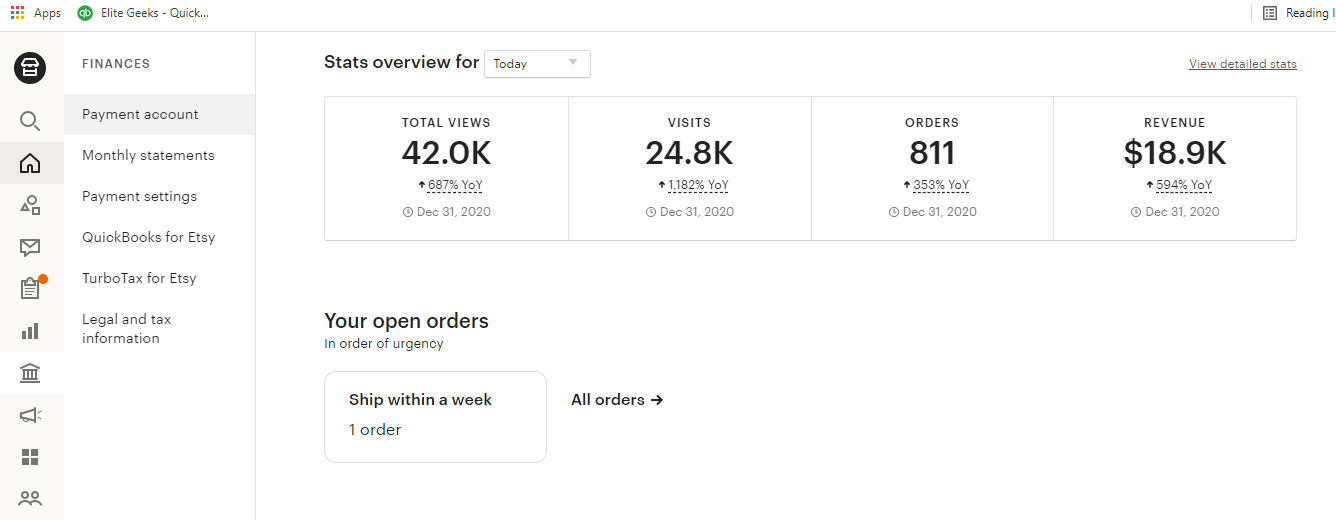

- Go to your Shop Manager

- Go to Finances

- Go to Payment Account

Like this

- Click on the payment account

- At the bottom of the payment account, you will see your monthly statements

- We want to select the right month to match the Etsy deposits to the actual bank deposits (in this case I am going to use February as an example)

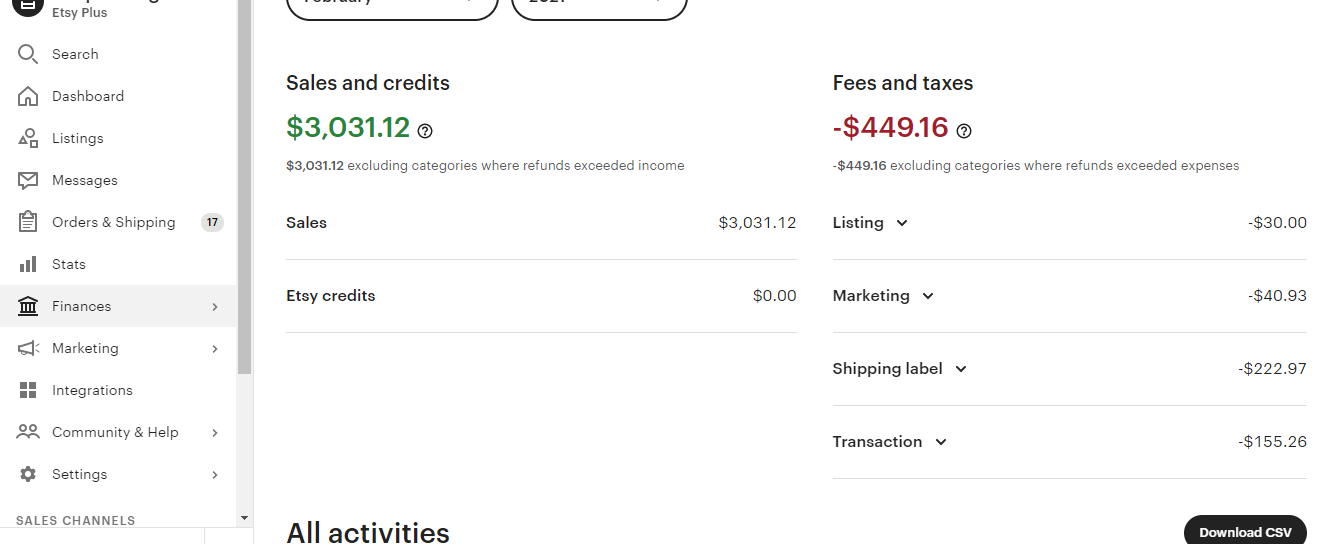

- It will look like this

- Now, do you see the “download csv” button

- Click that

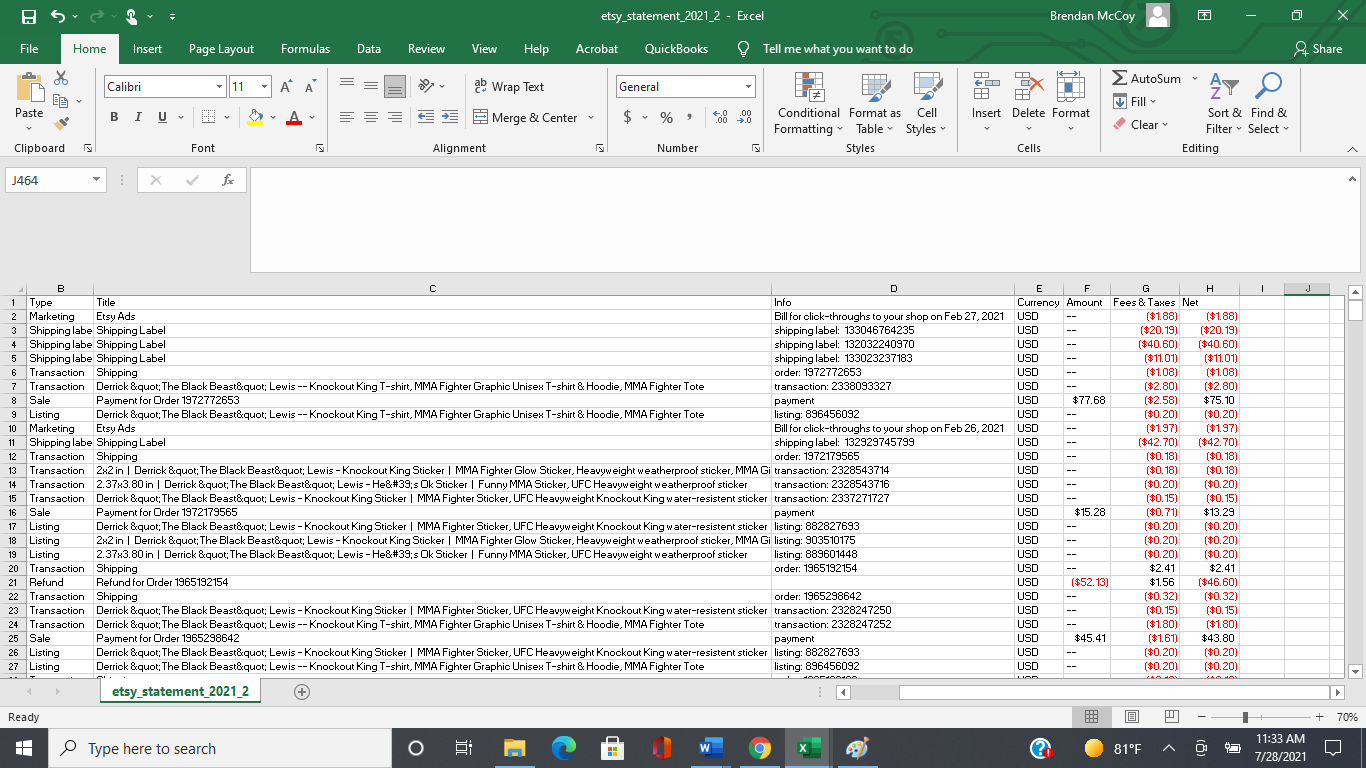

- It will open up a csv file that looks like this

This is where we can start matching the Etsy deposits to the bank deposits, but it is not that easy so pay attention…

Something I should make note of is this…

Etsy, like your bank account, carries a balance from month to month…meaning…

You could make sales in January that you have NOT deposited into your bank account. I think this is where most Etsy sellers get confused because they look at their Etsy sales report for January and see sales that were available for deposit, but the money never actually made it into the bank.

The reason that this happens is because sometimes Etsy holds on “reserve money” for their fees and sometimes you just leave money in their yourself. But you have to think about this reserve balance as an actual balance….meaning what you see on your etsy sales may not agree to your etsy deposits which may not agree to your etsy monthly statement.

It gets confusing, so let’s make this easy.

What I am going to do is break this down for one single deposit so you can see the process….

What I am also going to do is to start when I have a zero balance in my Etsy account so it is easier to digest, meaning I JUST deposited money from Etsy into my bank and cleared out the Etsy account to $0

If you look in your Etsy monthly statement in your Etsy shop manager on the right-hand side it breakdowns how your balance is calculated

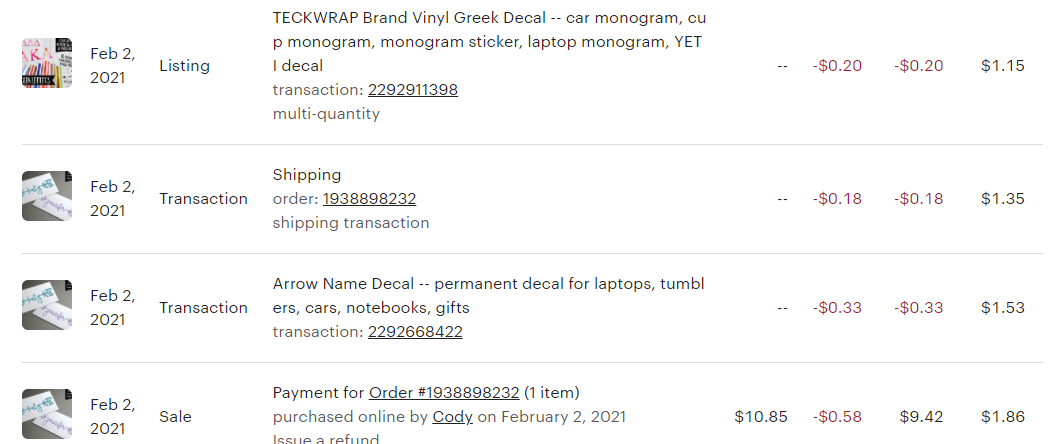

Here is a screenshot of the monthly statement activity…

Do you see at the very bottom of this screenshot I start with a zero balance?

This is important to note because we can then go from here and see what is actually happening.

You can see above the zero balance that Etsy is starting to take shipping label fees and transactions from your Etsy “bank” and it is reducing the amount of funds you have.

If you think about it like this, you now technically “owe” Etsy $2.20 for these shipping labels UNTIL you make another sale.

Not only does Etsy take your shipping label fees, but it will also take additional listing fees, Etsy offsite ad fees, and will also take your sale processing fees as well…causing this negative balance to be more and more until you make another sale

Now, thankfully you will make another sale and this balance will go up and here is where the fun really begins…

Let’s go to our first sale before we go into reconciling the reports to your bank…

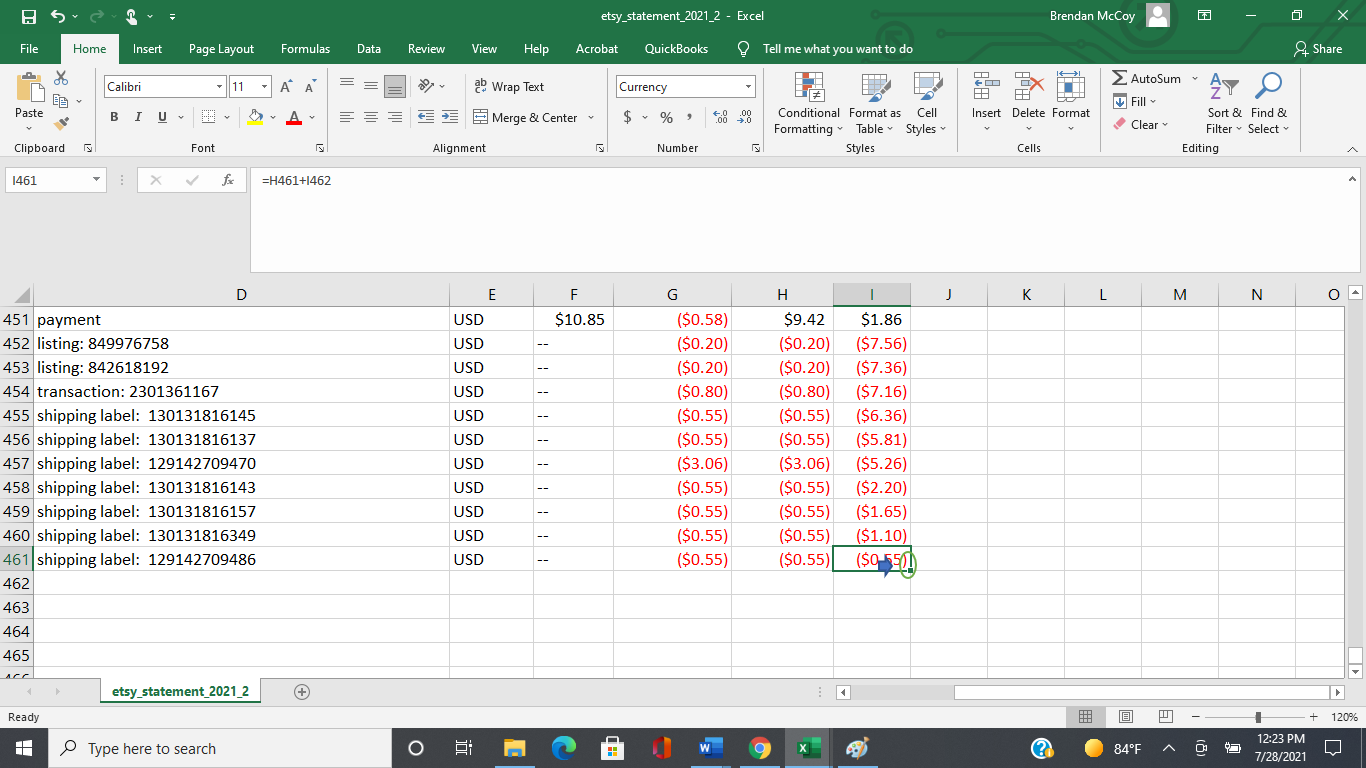

After racking up $7.56 of fees, this seller finally made a sale for a $10 item….

You can see right here my balance in my Etsy bank account is now $1.86 after making this sale

Ok, so $10 item minus the $7.56 balance for Etsy fees should equal $2.44, so why do I have $1.86 available? And why does it say $10.85 for this sale???

Here is where the reconciling really beings…

Let’s first go over the $10.85 part….

The reason that this says $10.85 in your monthly statement is because this INCLUDES $.85 of Etsy sales tax that Etsy collected for you.

But for now, we can ignore it, it is just here for reporting purposes.

With that said, the number you want to be aware of is the $9.42, THIS is the amount you get after the $10 sale and an additional $.58 fee processing fee.

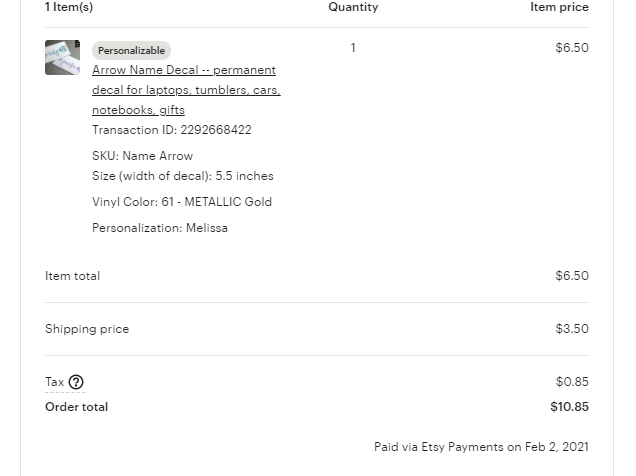

Here is what the actual order looks like…

You can see the total order (including shipping charged to the buyer) is for $10 PLUS $.85 of sales tax that Etsy collected.

Etsy calculates their fee based on the actual gross sale ($10) and deducts their processing fees, in this case $.58, leaving you with $10 minus $.58, or $9.42

This $9.42 minus the negative balance of $7.56 equals the amount you get deposited for $1.86…

That is how that works….

So, on a larger scale, to match what Etsy deposits to your bank account, you need to follow this process for each transaction on your monthly statement….but that gets annoying, especially if you have hundreds or thousands of transactions…

I will show you how to do this easily…

Let’s do it in excel for the whole month of February so you can see….

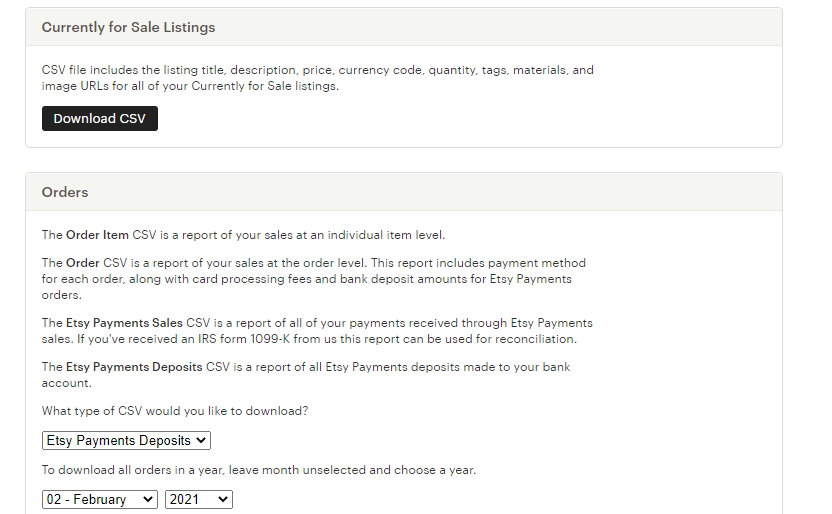

For this exercise you will need your Etsy Deposit Detail, along with the Etsy Monthly statement for February.

To get your Etsy Deposit Detail, go to

- Settings

- Options

- Download Data

- Then just select the right year and right month

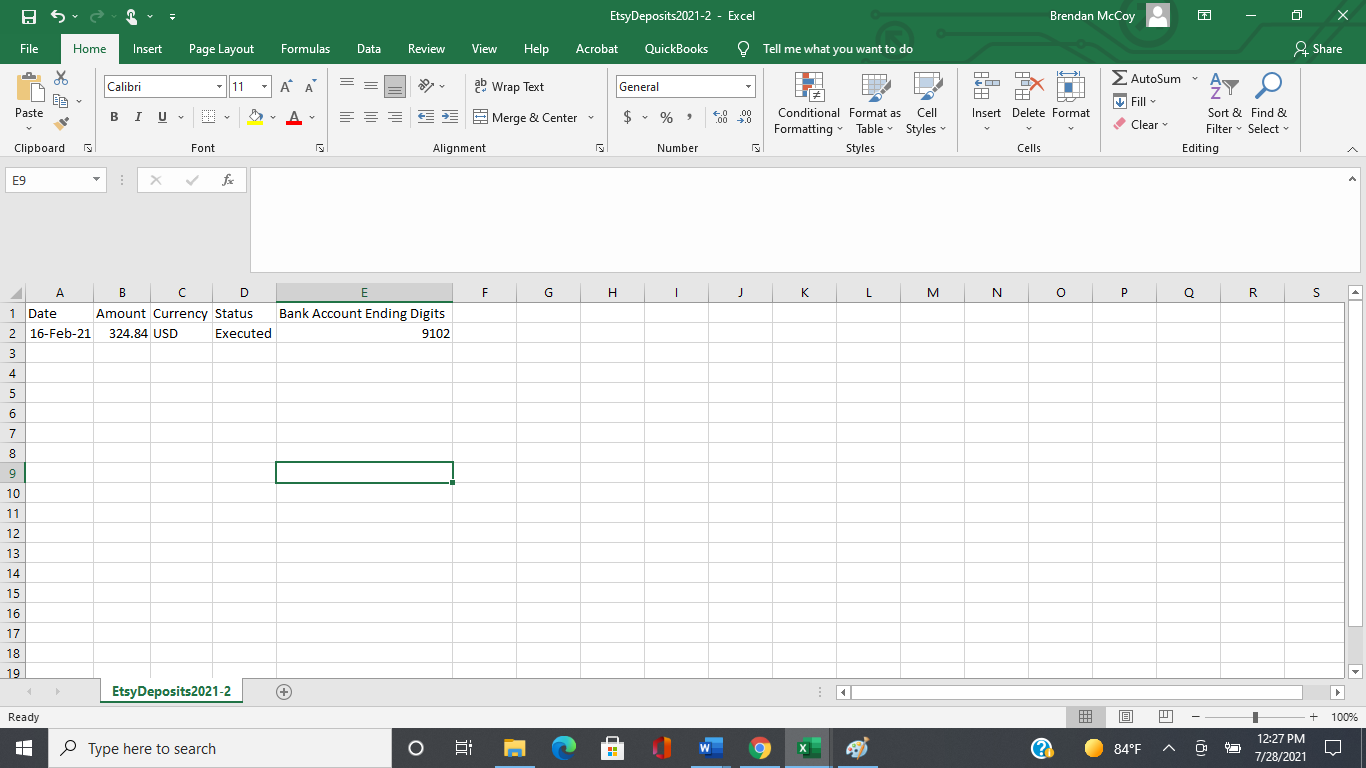

It will look like this for February

- Download this into a csv and this is how we will reconcile between the Etsy Deposit Detail and the Etsy Monthly Statement

This part is actually relatively easy…

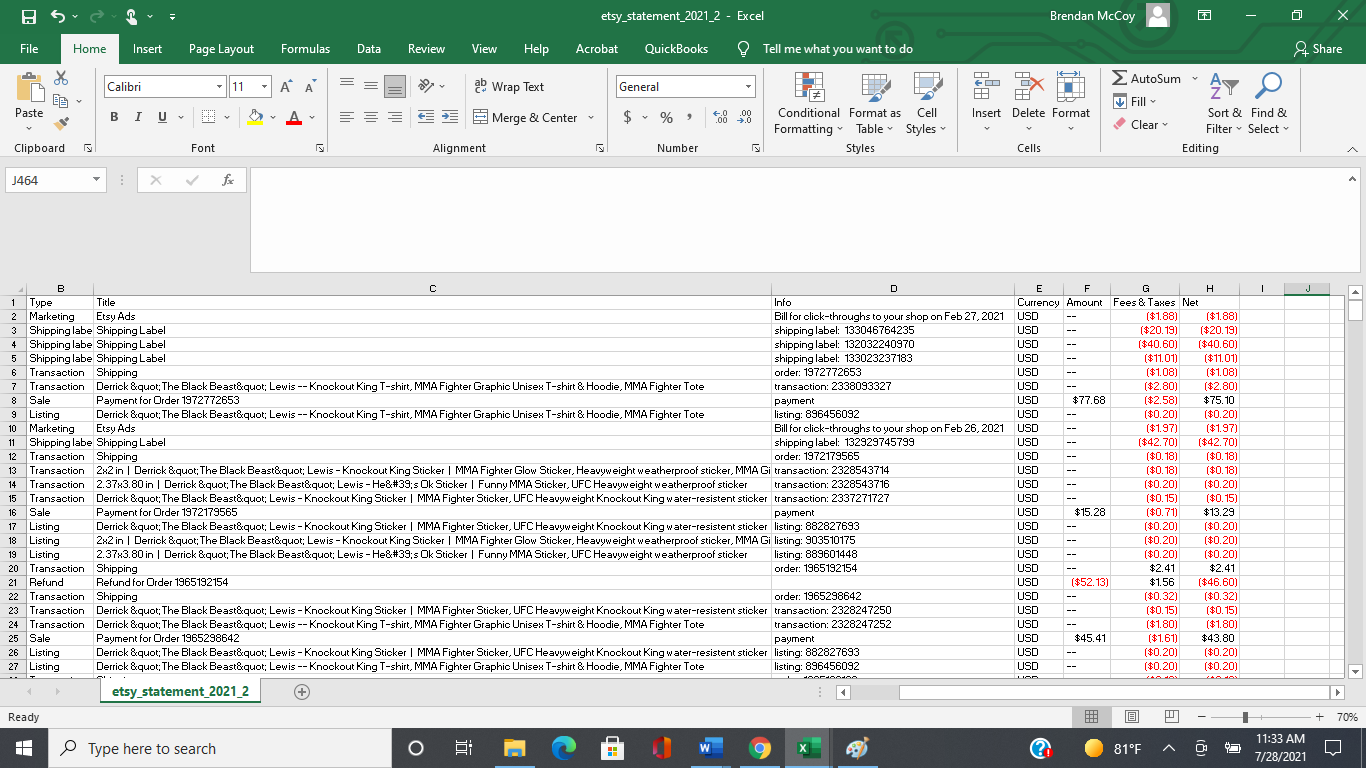

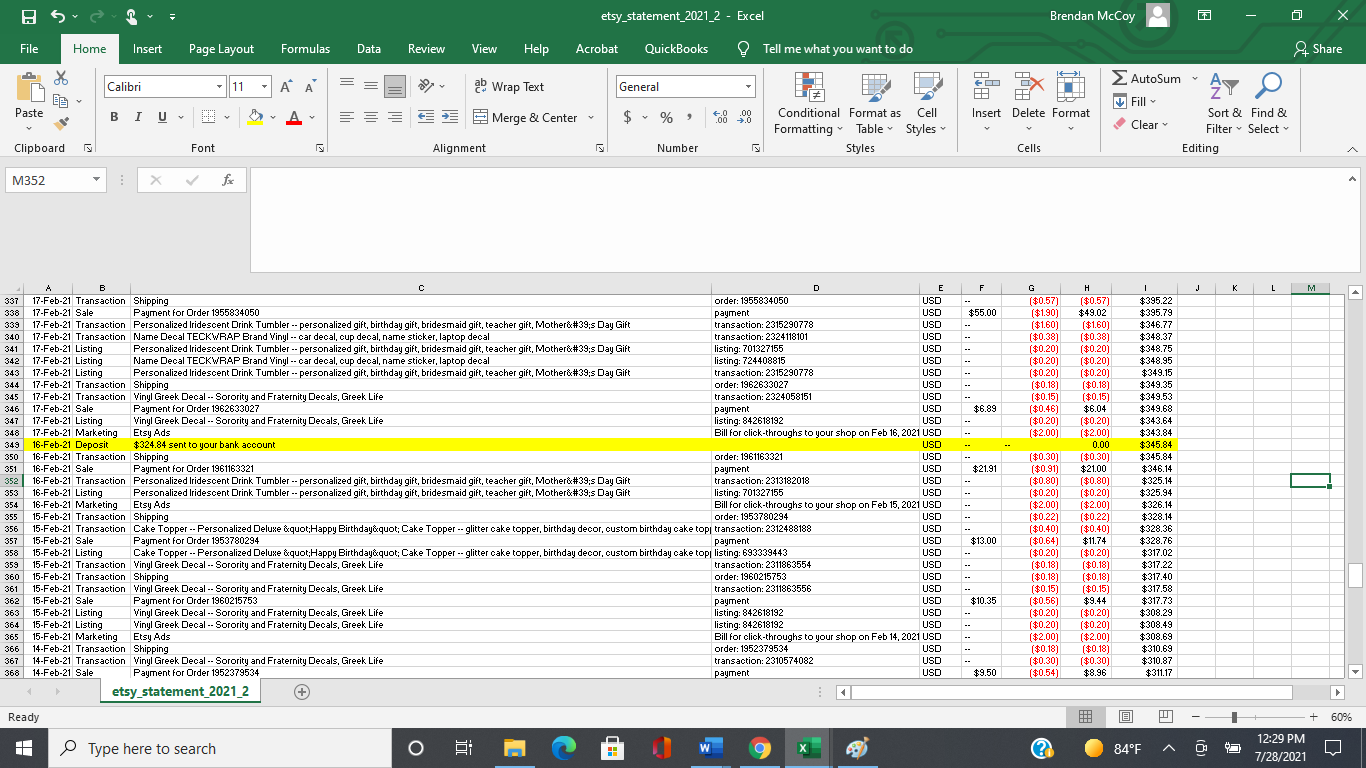

Let’s first go into the “Etsy Monthly Statement” csv

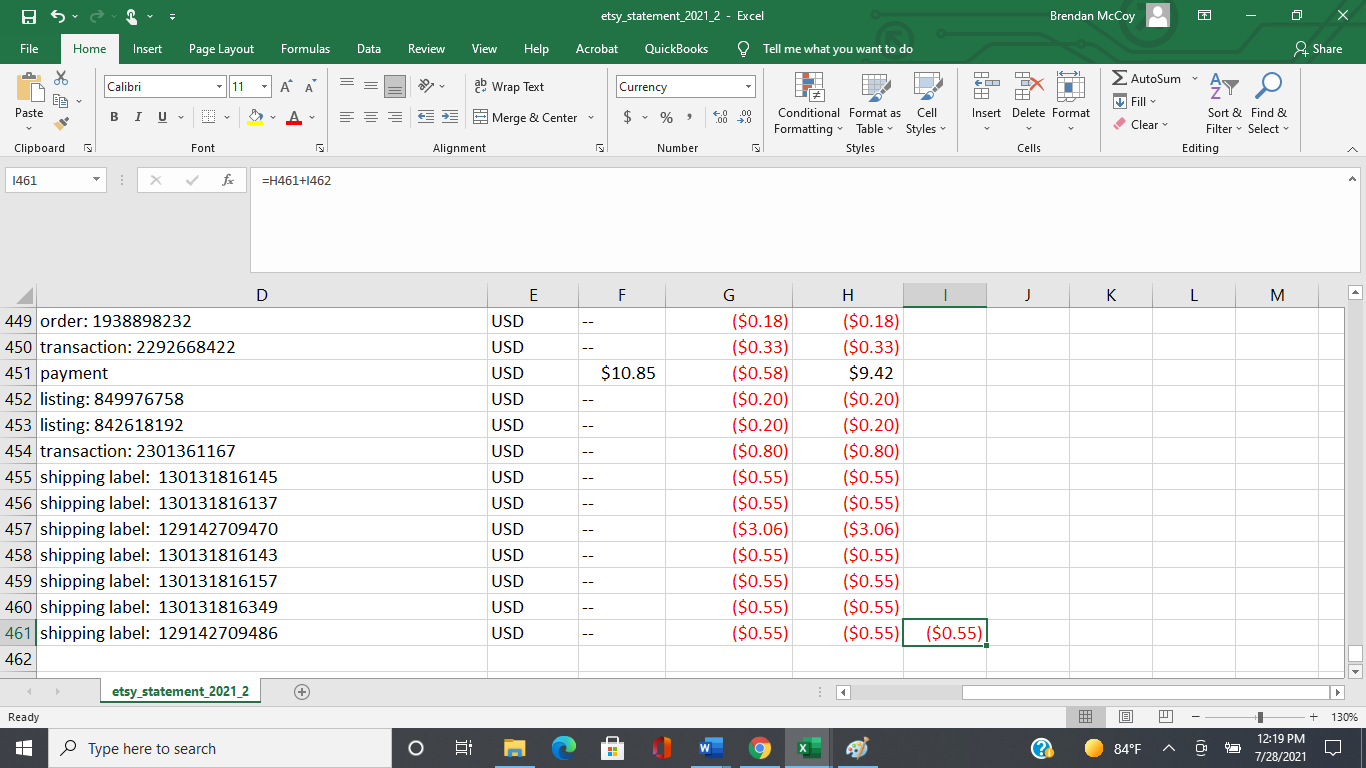

Here is what it will look like once you download it into a csv…

Now, you can see there are a lot of numbers in here, but only one we want to pay attention to…

This is column H…column H is the “net amount” that is making up the Etsy bank account balance

The fees are net already, but for the sales, column H will be the amount we get after an individual transaction processing fee.

You can see my example in row 451, it is the $10 sale minus the $.58 of transaction fees, or $9.42.

This $9.42 net PLUS all the fees I incurred will equal to $1.86 of balance available to put into my bank…

All I really need to do is a simple calculation just like this…in column I here is what I will do…

What I am trying to do here is to calculate the running balance that I have in Etsy…I do it like this

In column I, row 461 (the first one) I input this formula…

=sum(H461+I462)

What this is doing is taking the new transaction plus the balance of the old transaction.

It looks like this

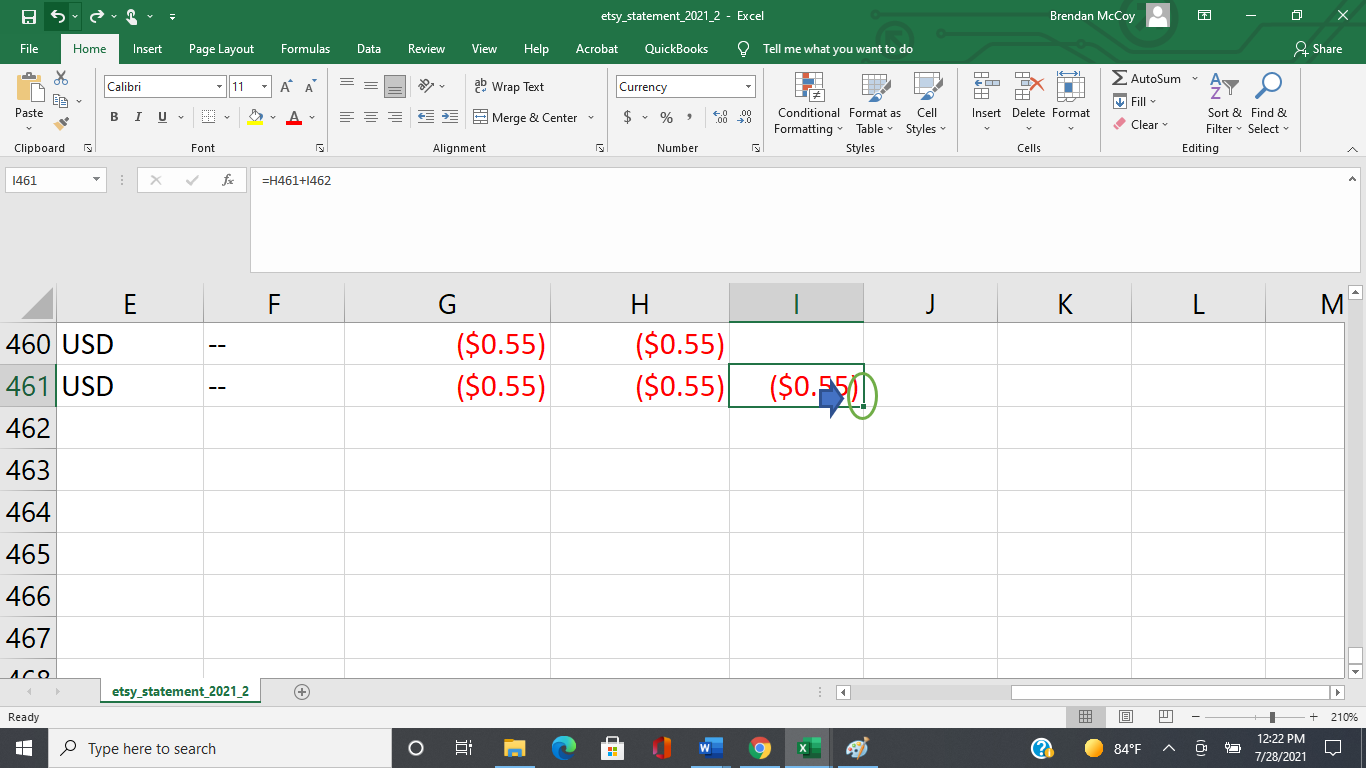

Now, in excel all I need to do is drag this formula up, just like this

I put my mouse on the bottom right like this

And I drag this box “UP” …what this does is apply this formula to every cell above and will give me my running balance, just like this…

You can see in row 451 column I, there is now a “balance” of $1.86, which agrees to our earlier investigation above…

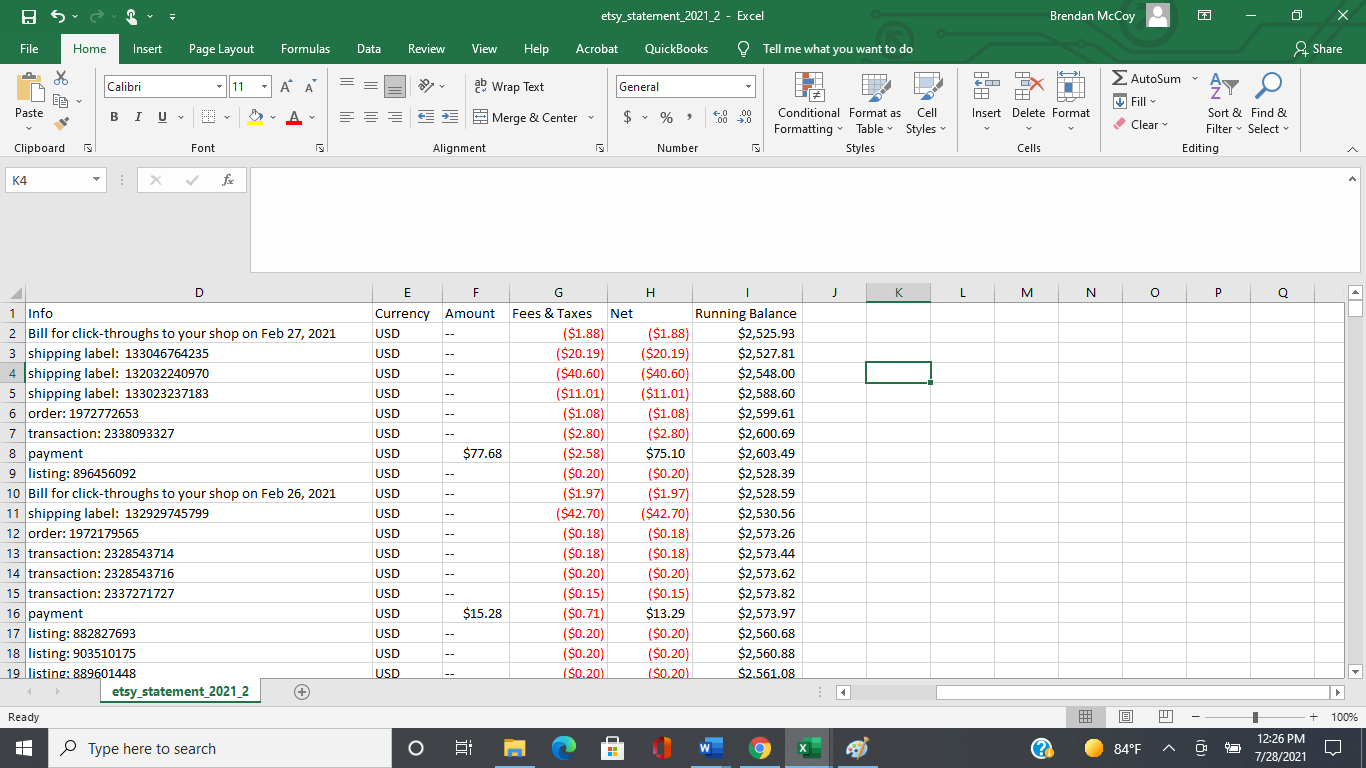

All I need to do now is drag this formula ALL the way to the top and reconcile it against my Etsy Deposit Detail…

Like this

You will see at the end of February; I have a $2,525.93 balance but this is actually NOT the correct balance and I think this is where sellers get confused…. there is one more thing we need to do to be finally correct in matching Etsy deposits to actual bank deposits

So, how do we do this?

Just like this…

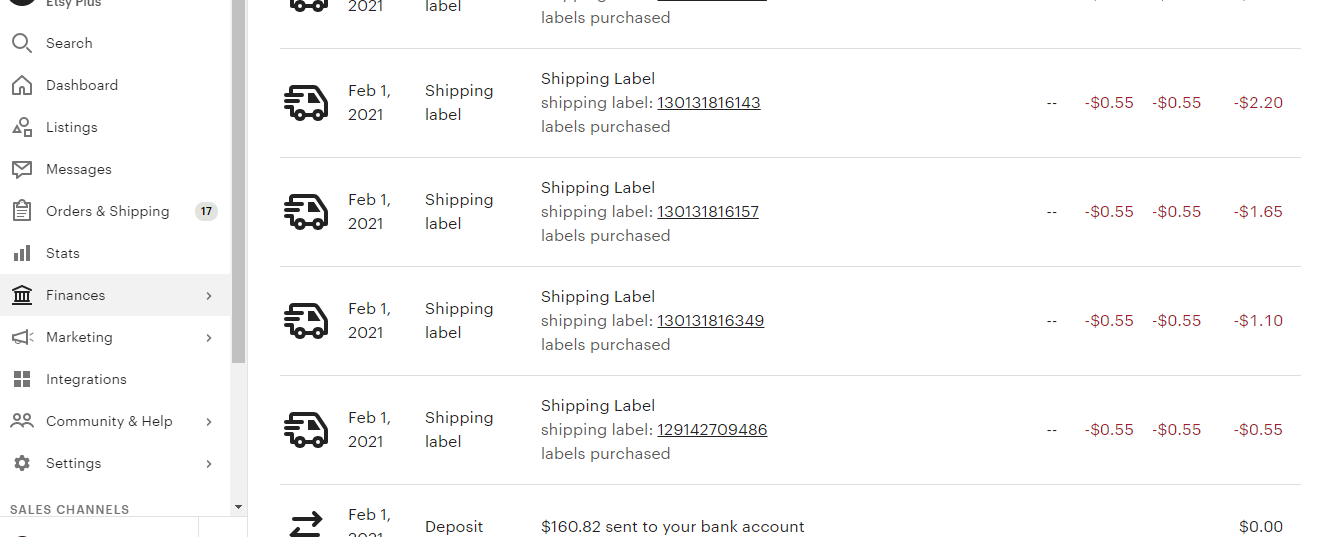

Go to your Etsy Deposit Detail spreadsheet that we downloaded earlier, it will look like this..

As you will see, Etsy is only deposited $324.84 into my actual bank account on 2/16/21….a far cry for the $2,500….so what happens now?

What I would do is check this deposit against my monthly statement and see what is happening…

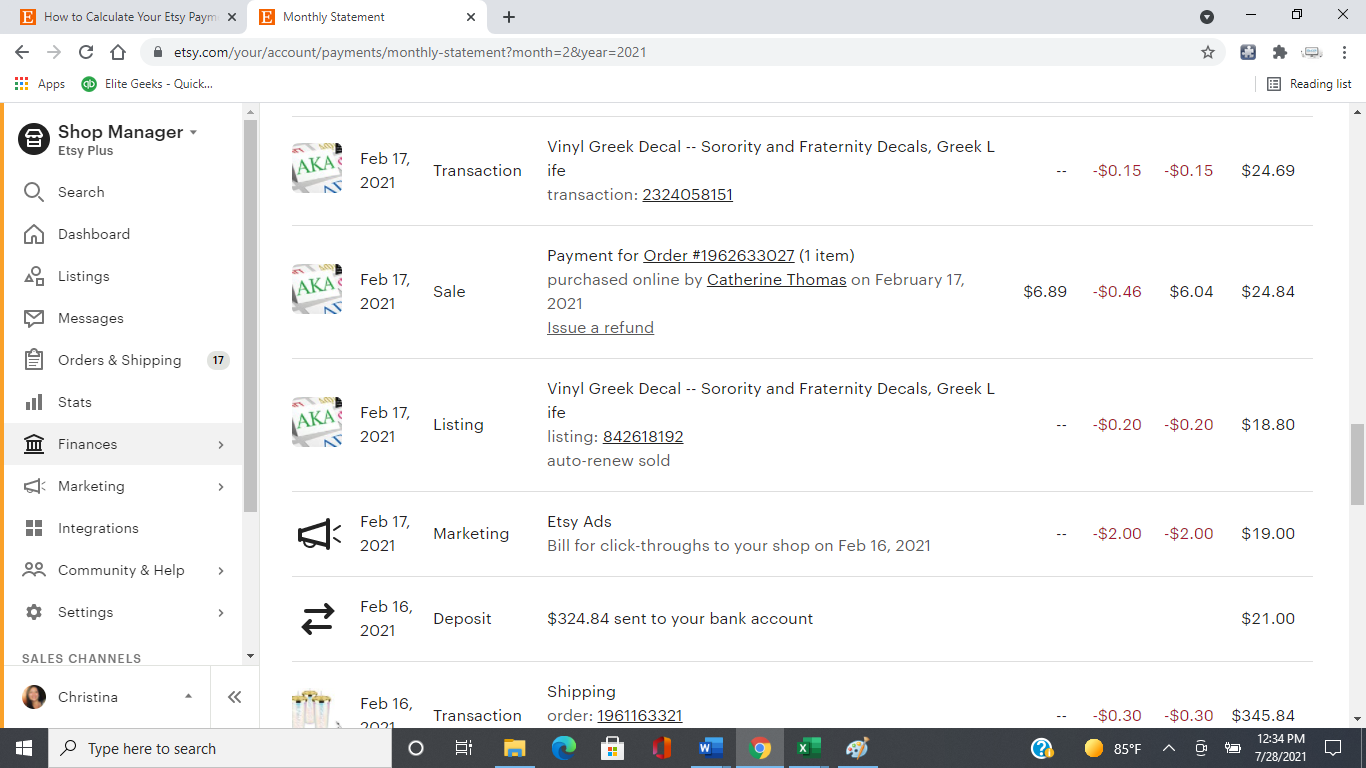

If I go to 2/16/21, I will see a bank deposit from Etsy in my monthly statement for $324.84. Just like this…

Ok…. but Etsy said I had a balance of $345.84 balance on that day? Are they NOT giving me my money?

No, they are giving you your money, but you only transferred $324.84 on that day and you are leaving a $21 balance in your account…to cover fees, additional shipping labels or whatever is may be…

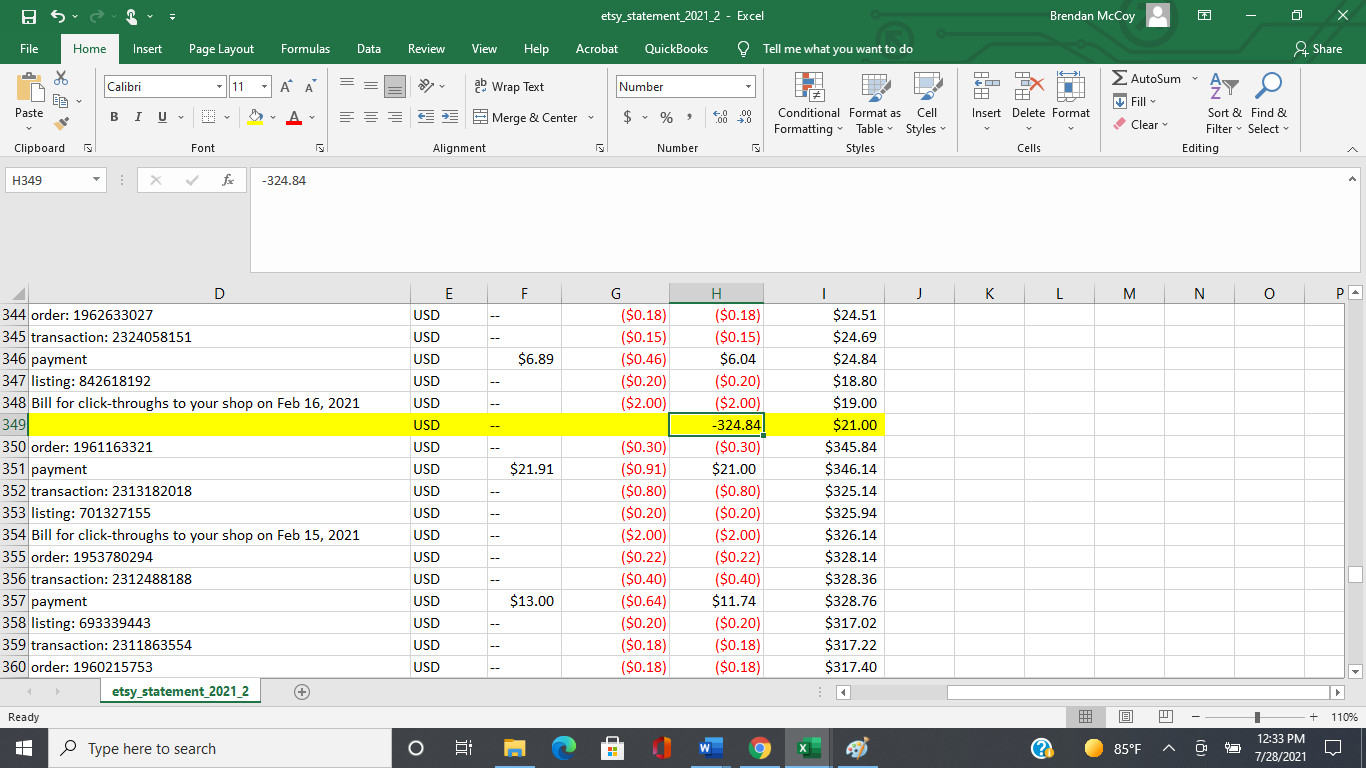

The final step in this process is to head back to your Etsy monthly statement csv and input a negative $324.84 in column H, this will keep the balance correct and reconciled to the actual Etsy deposit detail…

Like this…

You can see my running balance is now $21 left over and if I check that against my actual funds held in reserve or available it agrees…

That is that.

I reconciled my Etsy Deposits to my Etsy Monthly Statement to my actual bank account and know I know why they don't always agree...

So, with all of this said.

How do I actually do my Etsy bookkeeping and reconcile my expenses?

While I think excel is fine to use, as you can see above, it can get a little messy…especially the part where you have to manually calculate data and one slip of a finger and you could be lost for good…

The other thing is that in order to reconcile the bank to your monthly statement to your Etsy account at no point do we ever talk about GROSS sales. Because both reports we looked at are NOT the correct report. There is actually another report we will need to use and that is the Etsy direct checkout payment report.

Some people think the monthly statement will work, but here is why it will NOT. Remember from above when we talked about the $10.85 of “sales”, but $.85 is actually sales tax collected by Etsy? That $.85 is not a taxable event for your Etsy shop, meaning, it is not income and it is not an expense. Sales tax collected by Etsy is just a liability, meaning, Etsy is just holding that money (they are you never see this) and then they remit this to the state.

In order to find out the true amount of gross sales and what gets reported to the IRS you will need to look at your Etsy Sales Report. I can cover this in another blog post later…but

Here is what I recommend you do so that you can get your true gross sales, reconcile your bank account AND get accurate accounting for your Etsy shop…

I recommend getting a system like QuickBooks Self-Employed or QuickBooks Online.

The reason that I recommend using this is because you can actually link your Etsy account with you QuickBooks self-employed and integrate Etsy and QuickBooks rather seamlessly.

Not only can you integrate it and automate your bookkeeping for your Etsy shop, QuickBooks self-employed will allow you to see your estimated taxes, you can store your receipts, see real life data and add in mileage and other tax deductions to make tax time a breeze.

I actually have an online interactive course that teaches you how to use QuickBooks self-employed for your Etsy shop, along with other key things Etsy sellers need to know, like what to do when you first start your Etsy shop. What licenses and permits you need as an Etsy seller. The age-old question of do you actually need an LLC for your Etsy store and go into detail on how the whole tax thing works, along with a real life walk through how to use QuickBooks with a real Etsy seller client of mine. Think of this blog post with WAY more detail and insights about this stuff.

I also walk you through how to price items for your Etsy shop, how to manage inventory and I think the best part of it is that I do not disappear.

2x a month I hop on a live zoom call with the 150 or so members to discuss all things Etsy taxes, Etsy bookkeeping, Etsy accounting, Etsy pricing and Etsy inventory.

You can check out the course right here!

Grab all my free stuff right here!